Pv of future cash flows calculator

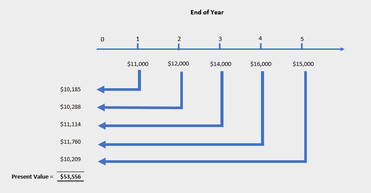

In order to calculate NPV we must discount each future cash flow in order to get the present value of each cash flow and then we sum those present values associated with each time. FV is the future value the principal plus interest on the annuityIn the case when all future cash flows are positive or.

2022 Cfa Level I Exam Cfa Study Preparation

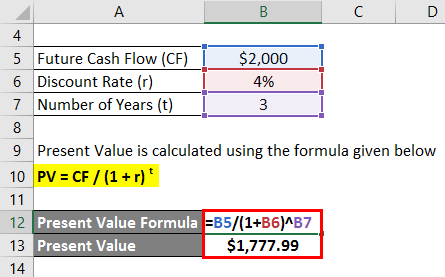

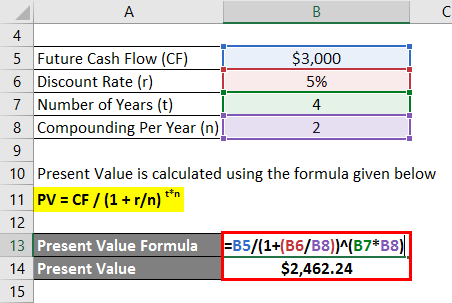

Present Value is calculated using the formula given below.

. Ad QuickBooks Financial Software. Present value PV is the current value of an expected future stream of cash flow. More specifically you can calculate the present value of uneven cash flows or even cash flows.

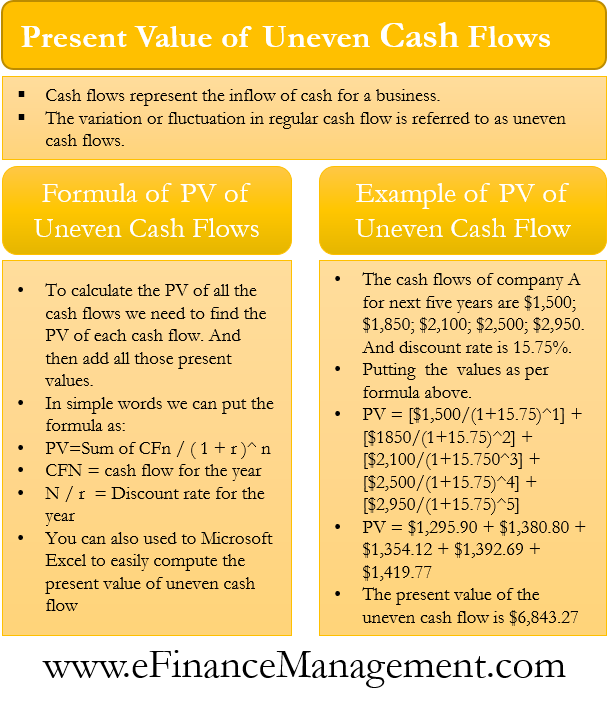

In order to find out the present value of uneven cash flows put your values in the following formula. Investment Calculator Future Value Calculator Present Value Present Value or PV is defined as the value in the present of a sum of money in contrast to a different value it will have in the. Using the example the formula is 3300 1101 where.

Calculate the present value PV of a series of future cash flows. Ad Build Your Future With A Firm That Has 85 Years Of Investing Experience. PV CF 1 r t.

Whatever Your Investing Goals Are We Have the Tools to Get You Started. The future value calculator uses multiple variables in the FV. Rated the 1 Accounting Solution.

The future value formula is FVPV 1i n where the present value PV increases for each period into the future by a factor of 1 i. This Calculator calculates present value of an amount receivable at a future date at any desired discount rate. Input 10 PV at 6 IY for 1 year N.

Use this online PV calculator to easily calculate the Present Value aka. Ad Create accurate Balance Sheet and Cash Flow statements synchronized to your budget. Present value can be calculated relatively quickly using Microsoft Excel.

CF for Year 1 1 r 1 CF for Year 2 1 r 2 CF for Year 3 1 r 3. Pressing calculate will result in an FV of 1060. Rated the 1 Accounting Solution.

To include an initial investment at time 0 use Net Present Value NPV Calculator. Ad QuickBooks Financial Software. Our Business Consultants Will Partner With You To Build Financial and Operational Success.

Planning Maestro quickly projects cash flow and models multiple business scenarios. This is the frequency of the corresponding cash flow. We can ignore PMT for simplicitys sake.

Present Worth of a future sum of money or stream of cash flow based on the rate of. PV is the present value the principal amount of the annuity. It is possible to use the calculator to learn this concept.

Enter the calculated present value the discount rate as the annual interest rate and set the other. Ad Our Business Experts Provide An In-Depth Analysis To Uncover Business Opportunity. The present value can be calculated at the chosen discount rate for any odd.

Calculate the present value of all the future cash flows starting from the end of the current year. If you would like to test the PV result for accuracy you can use this future value calculator. Present value equals FV 1r n where FV is the future value r is the rate of return and n is the number of periods.

How To Use Discounted Cash Flow Time Value Of Money Concepts

Present Value Of A Single Cash Flow Finance Train

Using Pv Function In Excel To Calculate Present Value

Present Value Formula Calculator Examples With Excel Template

Present Value Pv Formula And Calculator

Present Value Of Uneven Cash Flows All You Need To Know

Present Value Pv Formula And Calculator

Future Value Of A Single Cash Flow Finance Train

Present Value Formula Calculator Examples With Excel Template

Microsoft Excel Time Value Function Tutorial Uneven Cash Flows Tvmcalcs Com

How To Compute The Present Value Of An Asset Simtrade Blogsimtrade Blog

How To Use The Excel Npv Function Exceljet

Dcf Formula Calculate Fair Value Using Discounted Cash Flow Formula

Microsoft Excel Time Value Function Tutorial Uneven Cash Flows Tvmcalcs Com

Present Value Of A Mixed Stream Cash Flow Accounting Hub

Present Value Of Cash Flows Calculator

Present Value Formula Calculator Examples With Excel Template